401(k) withdrawal penalties are no joke – they can seriously impact your financial future. Get ready to dive into the world of penalties, exceptions, and tax implications in a way that’s cooler than the back of the school bus.

Let’s break down the penalties, exceptions, and tax consequences of making early withdrawals from your 401(k) account.

Overview of 401(k) Withdrawal Penalties

When it comes to 401(k) withdrawal penalties, it’s important to understand the consequences of accessing your retirement savings early. These penalties are designed to discourage individuals from dipping into their 401(k) funds before reaching retirement age.

- (k) withdrawal penalties typically apply in the following common situations:

- Withdrawing funds before the age of 59 1/2

- Taking out a loan from your 401(k) and defaulting on the payments

- Making non-qualified withdrawals from your account

The purpose of imposing penalties on early withdrawals is to ensure that individuals use their 401(k) funds for retirement purposes as intended. By penalizing early access to these funds, the government aims to promote long-term saving habits and discourage individuals from depleting their retirement savings prematurely.

Differentiating Penalties for Traditional and Roth 401(k) Accounts

When it comes to traditional 401(k) accounts, early withdrawals are subject to a 10% penalty in addition to income tax. This penalty is meant to deter individuals from withdrawing funds before retirement age and serves as a disincentive for early access.On the other hand, Roth 401(k) accounts have different penalty rules. While contributions to Roth 401(k) accounts are made with after-tax dollars, the earnings on these contributions are subject to penalties if withdrawn early.

Similar to traditional 401(k) accounts, early withdrawals from Roth 401(k) accounts before the age of 59 1/2 may incur a 10% penalty on the earnings, in addition to income tax.Overall, understanding the penalties associated with 401(k) withdrawals is crucial for individuals looking to make informed decisions about their retirement savings. It’s important to weigh the consequences of early access against the long-term benefits of preserving your retirement funds for the future.

Early Withdrawal Penalties

In 401(k) plans, withdrawing funds before reaching a certain age can result in early withdrawal penalties. These penalties are designed to discourage individuals from tapping into their retirement savings prematurely.

Standard Penalties and Age Criteria, 401(k) withdrawal penalties

- Standard early withdrawal penalties for 401(k) plans typically apply to individuals under the age of 59 1/2.

- Once you reach this age, you can start taking distributions from your 401(k) without facing penalties.

- Penalties may include a 10% tax penalty on the amount withdrawn in addition to any applicable income taxes.

- Exceptions may apply in certain circumstances, such as disability or specific financial hardships.

Impact on Retirement Savings

Early withdrawal penalties can have a significant impact on your retirement savings. By withdrawing funds early, you not only lose a portion of your savings to penalties but also miss out on the compounding growth that could occur if the funds remained invested. It is essential to carefully consider the consequences of early withdrawals and explore alternative options to meet financial needs without jeopardizing your future retirement security.

Exceptions to Penalties: 401(k) Withdrawal Penalties

In certain circumstances, individuals may be able to avoid penalties when withdrawing funds from their 401(k) accounts. These exceptions are designed to provide financial flexibility to account holders facing specific situations.

Hardship Withdrawals

Hardship withdrawals allow individuals to access their 401(k) funds without incurring penalties in cases of extreme financial need. Common reasons for hardship withdrawals include medical expenses, disability, education costs, and preventing foreclosure on a primary residence.

- Individuals must demonstrate proof of financial hardship to qualify for a penalty-free withdrawal.

- Hardship withdrawals are subject to income tax but exempt from the usual 10% early withdrawal penalty.

- Account holders should consult with their plan administrator to determine eligibility and requirements for hardship withdrawals.

Age-Related Exceptions

- Individuals who are age 59 ½ or older are typically exempt from early withdrawal penalties.

- Once an account holder reaches the age of 72, they are required to begin taking minimum distributions from their 401(k) to avoid penalties.

- Age-based exceptions are based on the premise that individuals have reached retirement age and should have access to their retirement savings without penalty.

Other Exceptions

- Penalty-free withdrawals may be allowed for qualified reservists called to active duty for more than 179 days.

- Some plans offer the option of a 401(k) loan, allowing account holders to borrow against their retirement savings without penalties.

- Divorce settlements or court orders may also provide exceptions to penalty-free withdrawals in certain situations.

Tax Implications of Withdrawal Penalties

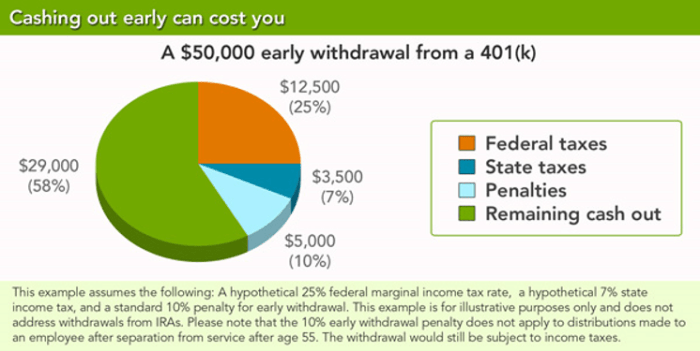

When it comes to withdrawing funds from your 401(k) and facing penalties, it’s important to understand the tax implications involved. Let’s dive into how withdrawal penalties are taxed, the difference in tax treatment between penalties and regular withdrawals, how penalties affect income tax calculations, and strategies to minimize the tax impact.

Taxation of Withdrawal Penalties

- Withdrawal penalties from a 401(k) are typically subject to both income tax and an additional 10% early withdrawal penalty.

- These penalties are considered ordinary income and are taxed at your marginal tax rate.

- For example, if your marginal tax rate is 22%, a $1,000 withdrawal penalty would result in a $220 tax liability.

Difference in Tax Treatment

- Regular withdrawals from a 401(k) are also subject to income tax but may not incur the additional 10% penalty if taken after reaching age 59 1/2 or meeting certain exceptions.

- Regular withdrawals are taxed as ordinary income, just like withdrawal penalties, but without the extra penalty.

Impact on Income Tax Calculations

- Withdrawal penalties increase your taxable income for the year in which the withdrawal occurs, potentially pushing you into a higher tax bracket.

- It’s crucial to factor in the impact of penalties on your overall income tax liability when planning for withdrawals.

Strategies for Minimizing Tax Impact

- Consider exploring exceptions to the early withdrawal penalty, such as using funds for qualifying medical expenses or first-time home purchases.

- If facing penalties, you may spread out the withdrawals over multiple years to lessen the tax hit in a single year.

- Consult with a financial advisor or tax professional to develop a withdrawal strategy that minimizes the tax consequences while meeting your financial needs.