Yo, so you wanna know about investment diversification, huh? Well, buckle up ‘cause we’re about to dive into this epic journey of spreading your investments and reducing risks. Get ready for some real talk about why diversifying is key for a solid portfolio.

In this guide, we’ll break down the different types of diversification, strategies for making it work for you, and the risks you need to watch out for. So, grab your snacks and let’s get started!

Importance of Investment Diversification

Investment diversification is like having a balanced diet for your money – it’s crucial for a well-rounded portfolio. By spreading your investments across different assets, you reduce the risk of losing all your money if one investment goes south.

Reduced Risk with Diversification

Diversifying your investments helps lower the overall risk in your portfolio. For example, if you put all your money into a single stock and that company tanks, you could lose everything. But if you spread your investments across various stocks, bonds, and real estate, a loss in one area won’t wipe you out.

Increased Opportunities for Growth

Spreading your investments across different asset classes also opens up more opportunities for growth. Each asset class performs differently under various market conditions, so by diversifying, you can benefit from the growth potential of each.

Protection Against Market Volatility

Market volatility is a reality, but diversification can help protect your portfolio. When one asset class is experiencing a downturn, another may be performing well, balancing out the overall impact on your investments.

Types of Investment Diversification

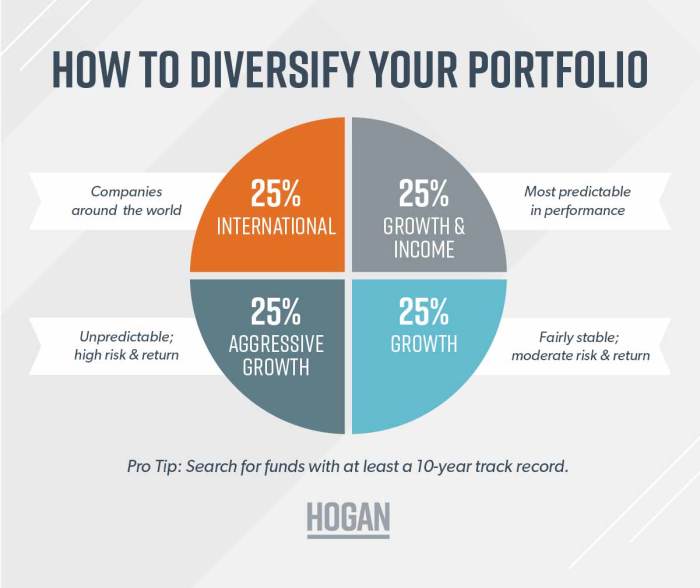

Investors have various ways to diversify their portfolios to manage risk and maximize returns. Diversification can be achieved through different asset classes, industries, and geographic regions.

Asset Class Diversification

Diversifying across different asset classes such as stocks, bonds, real estate, and commodities can help reduce overall risk. For example, when stock prices fall, bond prices may rise, balancing out the portfolio’s performance.

Industry Diversification

Investors can also diversify by investing in multiple industries. By spreading investments across sectors like technology, healthcare, and energy, investors can reduce the impact of negative events affecting a single industry.

Geographic Diversification

Geographic diversification involves investing in different regions or countries. This strategy helps protect against country-specific risks such as political instability, currency fluctuations, or economic downturns in a particular region.

Risk Comparison

Each type of diversification comes with its own risk levels. Asset class diversification helps reduce market risk, while industry diversification mitigates sector-specific risks. Geographic diversification, on the other hand, can protect against country-specific risks but may expose the portfolio to currency fluctuations.

Strategies for Effective Diversification

Investing can be a rollercoaster ride, but one way to minimize the ups and downs is through diversification. Here are some key strategies to help you effectively diversify your investment portfolio.

The Role of Rebalancing

Rebalancing is like hitting the reset button on your investments. It involves regularly reviewing your portfolio and adjusting the allocation of assets to maintain your desired level of diversification. By rebalancing, you can ensure that you are not too heavily invested in one particular asset class, reducing the risk of significant losses if that asset underperforms.

Aligning Strategies with Goals and Risk Tolerance

It’s essential to align your diversification strategies with your investment goals and risk tolerance. If you are a risk-averse investor, you may want to focus on spreading your investments across different asset classes to minimize the impact of market volatility. On the other hand, if you are comfortable with taking on more risk, you might consider investing in a mix of high-risk, high-reward assets to potentially maximize your returns.

Key Principles for Successful Diversification

- Diversify across asset classes: Spread your investments across stocks, bonds, real estate, and other asset classes to reduce the impact of market fluctuations on your portfolio.

- Consider global diversification: Investing in international markets can help you further spread risk and take advantage of opportunities in different regions.

- Monitor and adjust: Regularly review your portfolio and make adjustments as needed to ensure that your investments are still aligned with your goals and risk tolerance.

Risks and Challenges of Investment Diversification

When it comes to diversifying your investments, there are certain risks and challenges that you need to be aware of in order to make informed decisions. Let’s take a closer look at some of the potential drawbacks and obstacles that investors may encounter.

Over-Diversification

While diversification is essential for managing risk, it is possible to over-diversify your portfolio. When you spread your investments too thin across too many assets, you may end up diluting the potential returns. It can also lead to increased complexity in managing your portfolio and potentially higher costs.

Correlation between Assets

The effectiveness of diversification can be impacted by the correlation between assets in your portfolio. If your investments are highly correlated, they may move in the same direction during market fluctuations, reducing the benefits of diversification. It is important to consider the correlation between assets when building a diversified portfolio.

Challenges in Achieving Optimal Diversification

Investors may face challenges when trying to achieve optimal diversification. It can be difficult to find the right balance between different asset classes, sectors, and geographic regions. Moreover, market conditions and economic factors can change, affecting the performance of different investments and making it challenging to maintain an optimal level of diversification.